- #TURBOTAX REVIEW BEFORE FILE SOFTWARE#

- #TURBOTAX REVIEW BEFORE FILE PROFESSIONAL#

- #TURBOTAX REVIEW BEFORE FILE DOWNLOAD#

- #TURBOTAX REVIEW BEFORE FILE FREE#

Preparation: Tax return season 2023: What to know before filing your taxesĮarly birds: File your taxes early for a chance to double your refund money with Jackson Hewittįor example, “if you bought a home, you had one of the premier life changes that will fundamentally change your taxes,” Steber said. Usually, the move to itemized deductions comes after a major life change, said Mark Steber, chief tax information officer at tax preparer Jackson Hewitt. If your deductions exceed those amounts, you should probably itemize them to reduce your taxes. The standard deduction this year is $12,950 for single filers and married couples filing separately $19,400 for head-of-household filers and $25,900 for married couples filing jointly. You can check the IRS website to see if you qualify.

#TURBOTAX REVIEW BEFORE FILE FREE#

If your taxable income falls beneath certain thresholds, you have a disability or speak limited English, or are elderly, you may qualify for one of the IRS’ free filing programs.

#TURBOTAX REVIEW BEFORE FILE SOFTWARE#

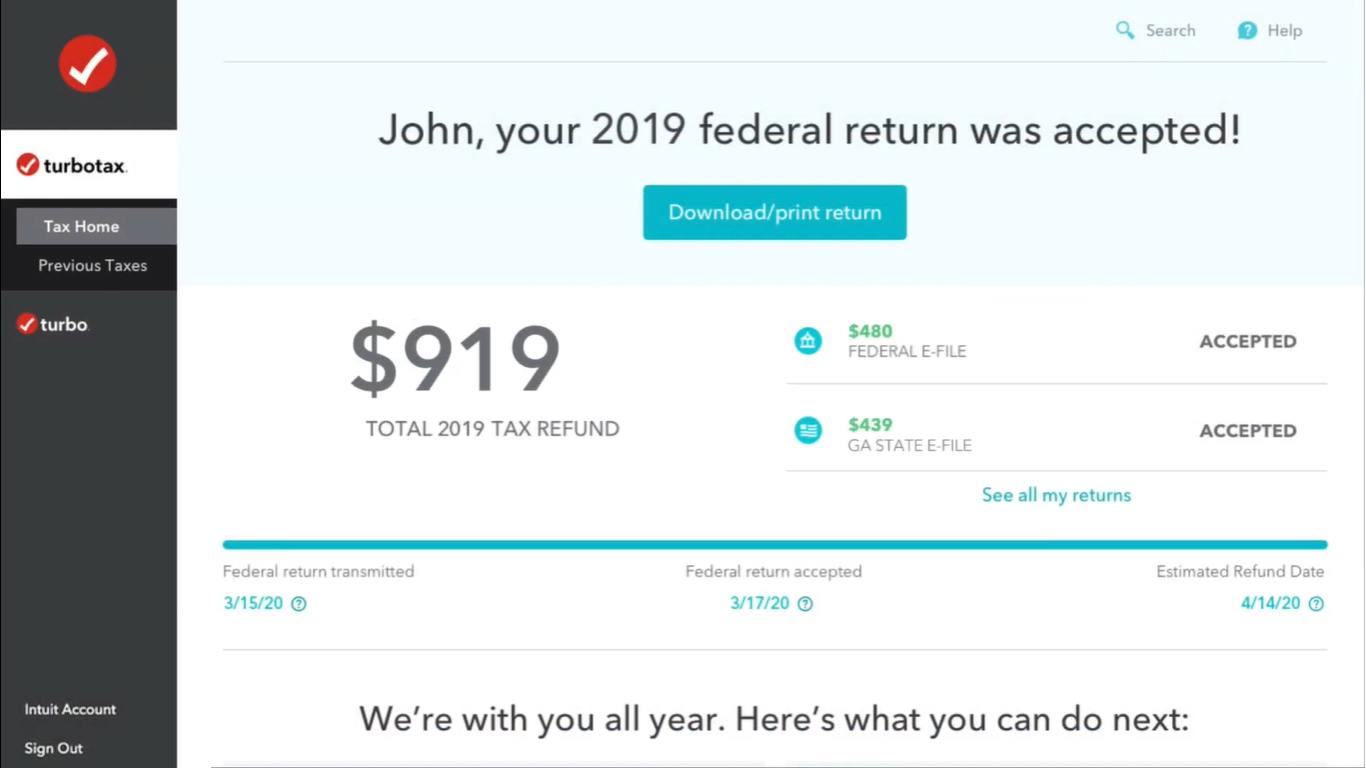

You can save yourself money and should be able to complete your tax return fairly quickly using basic tax software or the free forms found on the IRS website. If you have a limited number of income sources, say a W-2, bank accounts, and some 1099s, and you plan to take the standard deduction, doing your own taxes may be the way to go. After all, a wrong decision could cost you money or, worse, invite an audit.īe in the know: Are you ready to file your taxes? Here's everything you need to know to file taxes in 2023. We’ll unpack them here to help you make an informed decision. There are pros and cons to going it alone or enlisting help. Meanwhile, middle-income earners between $75,000 and $90,000 were the most likely (59%) to turn to a tax pro, the IRS said.

#TURBOTAX REVIEW BEFORE FILE PROFESSIONAL#

Thirty-three percent of people 18 to 24 used a tax professional compared with more than 50% in every other age group. An IRS study showed 53% of all taxpayers in 2021 used a paid tax professional, but Gen Z was significantly less likely than any other age group.

Typically, DIY taxpayers are young, just starting adulthood and owners of few assets. It depends on how messy your finances are, how much you hate doing taxes, or if you’ve had a recent life change. Like almost anything related to taxes, it’s complicated. We even learned to bake our own bread and cut hair. A standard deduction and few income sources, though, usually means you can probably go it alone.ĭuring the pandemic, we all became do-it-yourselfers of everything from home renovations to portfolio management.It depends on how complicated your taxes are, accountants say.

#TURBOTAX REVIEW BEFORE FILE DOWNLOAD#

Download Black by ClearTax App to file returns from your mobile phone. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. Save taxes with Clear by investing in tax saving mutual funds (ELSS) online. Clear can also help you in getting your business registered for Goods & Services Tax Law. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing.ĬAs, experts and businesses can get GST ready with Clear GST software & certification course.

You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Just upload your form 16, claim your deductions and get your acknowledgment number online. Clear serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India.Įfiling Income Tax Returns(ITR) is made easy with Clear platform. Clear offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India.

0 kommentar(er)

0 kommentar(er)